Homeownership 101

Your starter guide to building a legacy through real estate. Simple breakdowns, smart strategies, and Coach Moore gems that help you go from renter mindset → homeowner energy step by step.

Homeownership 101: When One Financial Move Pushes You Back Into Renting

Homeownership 101 for renting families breaks down how one credit hit, car purchase, or timing issue can delay buying…and how to reset with a real plan.

Why “Affording” a Home Is Not the Same as Being Ready for One

If you put more time into planning a vacation than preparing for homeownership, you’re not ready to buy. This Homeownership 101 reality check breaks down why readiness matters more than desire, how smart buyers prepare before they shop, and what it really takes to turn ownership into long-term wealth instead of financial stress.

The Truth About “Dream Homes”: Why Smart Buyers Start Smaller

The dream home sounds good, but smart buyers know starting smaller creates flexibility, protects cash flow, and builds leverage. This Homeownership 101 breakdown explains why your first home should be a strategic move not a financial trap, and how intentional ownership sets the foundation for long-term wealth.

Homeownership 101: The Real Moves That Decide If You Win or Struggle as a Homeowner

Homeownership and good credit aren’t individual wins; they’re legacy tools. If your circle isn’t positioned to stand with you, the work isn’t finished. This Homeownership 101 breakdown challenges buyers and homeowners to move beyond personal success and start building systems that elevate the whole camp.

🏡 Homeownership 101: How Buying the Right Home Can Prepare You for a Million Dollar Net Worth

Homeownership 101 isn’t just about buying a house…it’s about buying right. The home you choose today can either lock you into survival mode or position you for long-term wealth, equity growth, and financial freedom. This guide breaks down how strategic homeownership lays the foundation for a million-dollar net worth, what most buyers overlook, and how…

💪🏾🏡How Single Moms Can Buy a Home Sooner Than They Think (Even on One Income)

Single moms aren’t behind; they’re under-informed. With the right strategy, down payment assistance, and smart planning, homeownership is possible even on one income. This guide breaks down how single moms can buy a home sooner than they think.

🔑 How to Build a Family Compound Using Duplexes, Tri & Fourplexes (Even on a Regular Budget)

💛A family compound isn’t a mansion, it’s a strategy. Discover how duplexes and fourplexes can help your family live together, support each other, and build real generational wealth on a regular budget.

✨ The Truth About “First-Time Buyer”: What If You Owned a Home Before?

Most people think “first-time homebuyer” means you’ve never owned a home before, but that’s not how the system works. If you haven’t owned a primary residence in the last 3 years, you’re officially considered a first-time buyer again. That means you may still qualify for grants, down-payment assistance, and special loan programs even if you’ve…

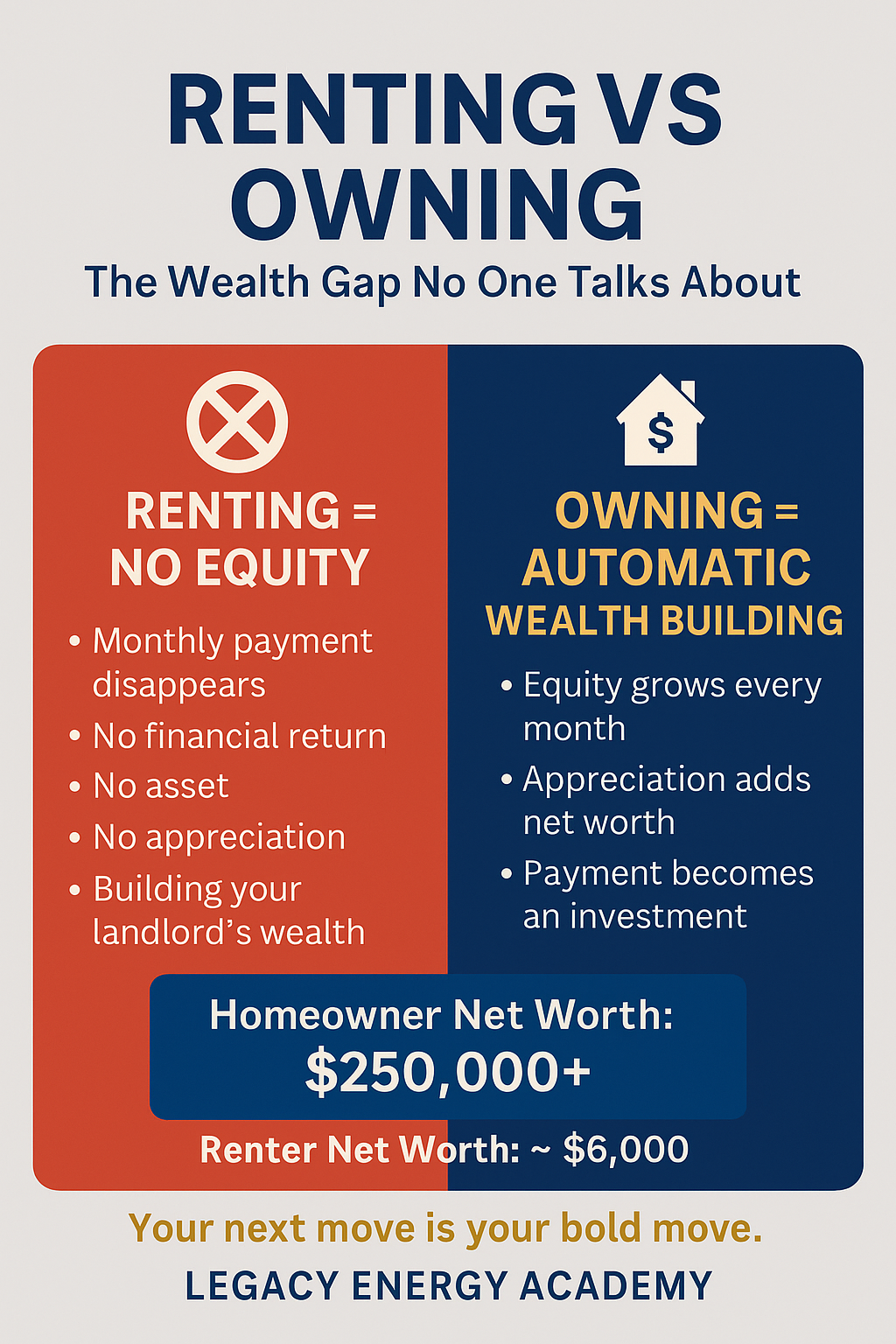

🏠 Renting vs Owning: The Wealth Gap No One Talks About

Most people don’t realize renting builds your landlord’s wealth, not yours. This blog breaks down the REAL wealth gap between renters and homeowners, and why ownership is the fastest path to generational wealth.

✨ Homeownership 101: Real-Talk Guide Nobody Gave Us

A real-talk guide to homeownership that cuts the fluff and breaks down what it REALLY takes to buy a home. If you can pay rent, you can build wealth. Here’s how to get started, step by step.